Cornwall and Isles of Scilly Investment Fund passes £10m milestone

Home News and events News Cornwall and Isles of Scilly Investment Fund passes £10m milestone

The Cornwall and Isles of Scilly Investment Fund has supported more than £10m of investment into 24 local businesses in its first two years of operation.

The £40m fund was launched in 2018 by the British Business Bank and the Cornwall and Isles of Scilly Local Enterprise Partnership to provide new and growing businesses with more funding opportunities.

Since then it has invested a total of £6.1m in 24 businesses from a wide range of sectors, attracting a further £4.6 million of private investment, making a total of £10.7m.

The fund provides debt and equity finance from £25,000 to £2 million. So far, eight local businesses have received £3.8m of equity funding and 16 businesses have received £2.3m of debt funding.

The £10m milestone was recently marked by a live one-hour webinar which celebrated local businesses that have benefitted from CIOSIF funding and discussed some of the challenges presented by the Covid-19 pandemic.

Ken Cooper, Managing Director, Venture Solutions, at the British Business Bank, said: “The fund has continued to invest through this difficult period, helping local businesses to grow and create jobs, and we’re delighted to be celebrating that success and the positive impact the fund is having on the local economy.

“There is no doubt that CIOSIF is now changing attitudes to external finance and is encouraging other private investors to participate. So we’re seeing a doubling of the impact, while raising awareness that Cornwall and the Isles of Scilly can be a good place to invest.”

LEP non-executive director John Acornley, who chairs the CIOSIF Advisory Board,said: “The LEP established the fund to increase the supply of finance to small businesses in our area to support their growth, so it is great to be celebrating this milestone. But this is about much more than money. Feedback from businesses shows they really value the support and expertise they receive from the fund to help them realise their goals.”

Research commissioned by the British Business Bank earlier this year and published in the summer showed that businesses in receipt of CIOSIF investment had seen a marked improvement in their performance and productivity with more skilled jobs, more investment in R&D and innovation, and the launch of new products and services.

Many of them said their project would have been delayed or not happened at all without the support of CIOSIF, and the fund had played an important role in helping them secure match funding from other sources.

The research also showed that 85% of businesses said engaging with the CIOSIF had made them more confident about raising funding from private sector sources in the future, which is seen as an important part of changing attitudes towards external finance and developing a sustainable market in the region.

CIOSIF is supported by the European Union using funding from the European Regional Development Fund (ERDF) as part of the European Structural and Investment Funds Growth Programme 2014-2020. It is operated by the appointed fund managers, The FSE Group.

For more information about the Cornwall & Isles of Scilly Investment Fund including how to apply, please visit www.ciosif.co.uk or follow the fund on Twitter at @CIOSIFBBB2

You can also watch the recent webinar marking the first two years of the fund via this link.

What businesses are saying about the Cornwall and Isles of Scilly Investment Fund:

Tim Edwards, CEO and Co-Founder of tech business Codices Interactive Ltd in Penryn, which has received £250k in equity funding from CIOSIF: “Getting the match investment has been a big help because we’re able to bring in other outside investors that were very happy to put money in. It’s really allowed us to increase our budgets and be able to get really strong people. Since we started we’ve already hired an extra 10 or so people so we’ve been able to massively increase what we’re doing and a lot of the money now we’re using to build up our proposition, really growing our team and going from a 4-5 person team to a proper corporate business.”

Lisa Hope, owner of Slickers Doghouse in Padstow, which has received a £32,000 loan from CIOSIF, said about working with the fund: “It’s been amazing. I’ve been put in touch with so many different parts of the organisation and it’s such a wealth of useful information. Obviously it has been fantastic that they’ve helped me to get the finances together so that I can actually move this business forward, but I feel that on a practical basis it’s more about their help and their support and they just come alongside you and really care about what you’re doing with your business, and not just what you’re doing with their money.”

Colin Phillipson, Director of agri-tech business Glas Data in Penryn, which has received £140,000 equity investment from CIOSIF: “The investment has helped us to accelerate to that point where we can start to become profitable. There’s always that gap with start-ups where you need that additional funding to propel you to the next stage. A fund like CIOSIF is really beneficial.”

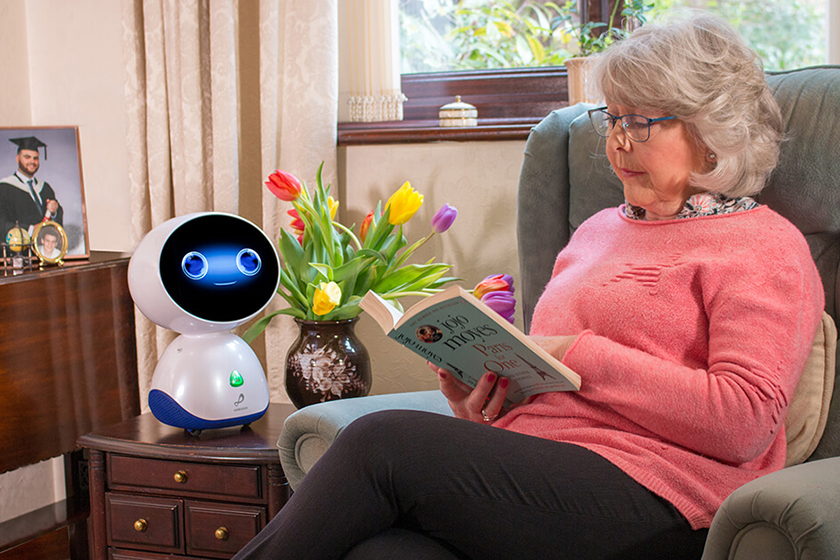

And Rob Parkes, Co-Founder and CEO of Service Robotics Ltd, which has received a £300k equity investment from CIOSIF to develop a companion robot for vulnerable and elderly people: “The fund has really got us on the journey to take our business from concept to the market. The fund has made a huge difference to our business because every start-up needs the backing of a serious significant investor to guide you through the journey and to be with you on that journey. This first step with the fund has been brilliant because the money has allowed us to develop the solution, take it through a pilot which is happening right now in Cornwall, and through to commercial reality next yet.”

About the Cornwall and Isles of Scilly Investment Fund (CIOSIF)

The £40m Cornwall & Isles of Scilly Investment Fund provides debt and equity finance from £25,000 to £2 million to help growing small businesses in Cornwall and Scilly. It has been established by the British Business Bank in partnership with the Cornwall and Isles of Scilly LEP and is operated by appointed fund

For more information about the Cornwall & Isles of Scilly Investment Fund including how to apply, please visit www.ciosif.co.uk or follow the fund on Twitter at @CIOSIFBBB2

The Cornwall and Isles of Scilly Investment Fund, supported by the European Regional Development Fund, is providing debt and equity finance, ranging from £25,000 to £2m, specifically to help small and medium sized businesses secure the funding they need for growth and development.

The Cornwall and Isles of Scilly Investment Fund is operated by British Business Financial Services Limited, wholly owned by British Business Bank, the UK’s national economic development bank. Established in November 2014, its mission is to make finance markets for smaller businesses work more effectively, enabling those businesses to prosper, grow and build UK economic activity.

The Cornwall and Isles of Scilly Investment Fund is supported by the European Regional Development Fund, the CIOS Local Enterprise Partnership and HMG grant funding.

The project is receiving funding from the England European Regional Development Fund as part of the European Structural and Investment Funds Growth Programme 2014-2020. The Ministry of Housing, Communities and Local Government is the Managing Authority for European Regional Development Fund. Established by the European Union, the European Regional Development Fund helps local areas stimulate their economic development by investing in projects which will support innovation, businesses, create jobs and local community regenerations. For more information visit www.gov.uk/european-growth-funding

The Government has guaranteed all funding allocated through EU programmes until the end of 2020. https://www.gov.uk/government/news/funding-from-eu-programmes-guaranteed-until-the-end-of-2020

The funds in which Cornwall and Isles of Scilly Investment Fund invests are open to businesses with material operations, or planning to open material operations, in Cornwall and the Isles of Scilly only.

The British Business Bank has published the Business Finance Guide (in partnership with the ICAEW, and a further 21 business and finance organisations). The guide, which impartially sets out the range finance options available to businesses and provides links to support available at a regional level, is available at www.thebusinessfinanceguide.co.uk/bbb

About the British Business Bank:

The British Business Bank is the UK’s national economic development bank. Established in November 2014, its mission is to make finance markets for smaller businesses work more effectively, enabling those businesses to prosper, grow and build UK economic activity. Our remit is to design, deliver and efficiently manage UK-wide smaller business access to finance programmes for the UK government.

The British Business Bank programmes were supporting more than £8bn of finance to over 98,000 smaller businesses at end of March 2020. Since March 2020, the British Business Bank has launched four new Coronavirus business loan schemes, delivering tens of billions of pounds of finance to over a million businesses.

As well as increasing both supply and diversity of finance for UK smaller businesses through its programmes, the Bank works to raise awareness of the finance options available to smaller businesses:

- The Business Finance Guide (published in partnership with the ICAEW and a further 21 business and finance organisations) impartially sets out the range of finance options available to businesses at all stages – from start-ups to SMEs and growing mid-sized companies. Businesses can take the interactive journey at thebusinessfinanceguide.co.uk/bbb

- The British Business Bank Finance Hub provides independent and impartial information to high-growth businesses about their finance options, featuring short films, expert guides, checklists and articles from finance providers to help make their application a success. The new site also features case studies and learnings from real businesses to guide businesses through the process of applying for growth finance.

As the holding company of the group operating under the trading name of British Business Bank, British Business Bank plc is wholly owned by HM Government and is not authorised or regulated by the Prudential Regulation Authority (PRA) or the Financial Conduct Authority (FCA).

The British Business Bank operates under its own brand name through a number of subsidiaries, none of which are authorised and regulated by the FCA.

British Business Bank plc and its principal operating subsidiaries are not banking institutions and do not operate as such. A complete legal structure chart for British Business Bank plc and its subsidiaries can be found on the British Business Bank plc website.